US can't reverse re

Shi Yu/China Daily。

The world is watching closely as the United States and China engage in high-stakes bilateral trade negotiations. While the immediate outcomes may be modest tariff adjustments or managed market access in selected sectors, those can be best understood as tactical responses to deeper structural tensions rather than strategic breakthroughs. The broader implications for global trade lie not in the specifics of such negotiations but in the shifts they signify: away from multilateralism and US dollar hegemony, and toward a new, multipolar global trade architecture.。

At the heart of the current tensions is the US' growing anxiety over its relative decentering. Having enjoyed more than three decades of the unrivalled global hegemony since the end of the Cold War, the US now finds itself challenged by China's rising technological prowess, industrial scale and global integration. Under the Donald Trump administration, the US' anxiety has transformed into an explicitly transactional, bilateral trade posture.。

The US has been increasingly dismissing multilateral institutions — for long the instruments through which Washington shaped global norms and gained geopolitical advantage — in favor of "deal-making" with individual countries, and projected this bilateralism, steeped in zero-sum logic, as strength. By doing so, it has exposed its strategic incoherence.。

For example, through its trade policy, the US administration tried to simultaneously increase domestic manufacturing output — by penalizing imports — and maintain the dollar's status as the global reserve currency. These goals are not easily reconciled. A strong global reserve currency fuels persistent trade deficits. Penalizing imports through tariffs does disrupt this dynamic but not without costs. If the US were to genuinely reindustrialize at scale, it would need to import huge volumes of capital goods and intermediate inputs, exacerbating the very trade deficit it seeks to narrow. The paradox is that narrowing the trade deficit would first require widening it.。

The alternative is simply to reduce overall aggregate demand in the economy by slashing public expenditure. That doesn't look like happening.。

More fundamentally, the hollowing out of US manufacturing was never principally a result of trade agreements. It was a symptom of a deeper reorientation of US capital. Over the past four decades, US capital has been progressively reallocated from industrial production to financial engineering, creating asset bubbles, stock buybacks and speculative real estate investment. Wall Street flourished as "Main Street" faded. The share of GDP derived from financial services soared, while fixed capital formation in manufacturing stagnated. Reversing this trend would require reducing the political and institutional power of finance, an unpalatable proposition for any administration.。

Yet the US still manufactures products such as high-end equipment and advanced electronics, and develops or advances technologies like aerospace technology and military technology. But their production is capital-intensive, not labor-intensive, and they don't fill the physical or emotional void created by the offshoring of everyday consumer goods manufacturing that began in the 1970s. The sense of economic alienation among broad swathes of the American working class is as much cultural as it is economic. Tariffs may meet some symbolic need for control or retribution, but they cannot restore the industrial base to its past state.。

Also, the rest of the world is adapting to the US' contradictions. The weaponization of the dollar, through sanctions and arbitrary financial restrictions, has catalyzed a slow but deliberate move toward alternatives. Some emerging economies are accelerating trade settlements in their national currencies and exploring alternative clearing mechanisms. ASEAN member states, on the other hand, are reducing their reliance on the dollar in regional trade, particularly with China, Japan and the Republic of Korea.。

Even the oil-rich Gulf Cooperation Council member states are diversifying their trade currency strategies. The demand for the dollar as a trade settlement medium is gradually diminishing, which the European Central Bank sees as an opportunity for the euro to play a more prominent role in global trade. This fragmentation is not a retreat from but a reconfiguration of globalization.。

The new globalization that is emerging is multipolar in character, regional in structure and decentralized in operations. Institutions such as the World Trade Organization will likely persist, offering an overarching framework for administrative and policy guidance. But much of the practical work of trade governance — harmonization of standards, digital commerce rules and investment arbitration — will occur in regional and bilateral forums. In this regard, the US-China negotiations are not anomalous but emblematic.。

For many countries, especially in the Global South, the US' retreat from multilateralism poses risks but also creates new space. The growing importance of South-South trade, supported by new infrastructure financing and currency swap arrangements, is reducing the Global South's dependence on Western markets and institutions, with the Belt and Road Initiative creating corridors of trade and production that bypass traditional Western trade bottlenecks.。

The US remains a major consumer market, responsible for about 14 percent of global imports. But its share in the global economy is declining, reflecting both its waning economic clout and the diversification of global demand. For exporters, aligning with the new regional poles of growth — in East Asia, South Asia and parts of Africa — will become increasingly important. And supply chains will be restructured to hedge against geopolitical volatility, balancing proximity, cost and political risk.。

The Sino-US trade tango should not be seen as the primary determinant of the future of global trade. Rather, it is a mirror of the broader historical shift: from unipolarism to multipolarism, from dollar dominance to currency diversification, from multilateralism to mosaic regionalism. The world isn't de-globalizing; it is re-globalizing on new terms and under new rules.。

The author is an adviser to former Australian prime minister Kevin Rudd, adjunct professor at Queensland University of Technology and a senior research fellow at Taihe Institute.。

The views don't necessarily reflect those of China Daily.。

(责任编辑:知识)

-

湖北日报讯记者张倩倩、通讯员张文佳)5月24日至25日,我国教育学会区域教育学术年会、我国教育学会学校教育学术年会在武汉举行。现场,我国教育学会区域教育立异研讨分会建立。我国教育学会是新我国建立最早、

...[详细]

湖北日报讯记者张倩倩、通讯员张文佳)5月24日至25日,我国教育学会区域教育学术年会、我国教育学会学校教育学术年会在武汉举行。现场,我国教育学会区域教育立异研讨分会建立。我国教育学会是新我国建立最早、

...[详细]

-

中新社北京7月3日电 《天然》杂志7月2日刊登一篇论文,初次证明了古埃及和美索不达米亚文明的居民之间存在生物学联络。路透社征引论文内容报导称,研讨人员日前对一位约4500年前生活在尼罗河谷的男人遗体进

...[详细]

中新社北京7月3日电 《天然》杂志7月2日刊登一篇论文,初次证明了古埃及和美索不达米亚文明的居民之间存在生物学联络。路透社征引论文内容报导称,研讨人员日前对一位约4500年前生活在尼罗河谷的男人遗体进

...[详细]

-

荆楚网湖北日报网)讯通讯员 陈园)7月3日,江陵县消防救援大队举行优化营商环境信誉修正)会议,助力失期企业重塑信誉,建造诚笃守信营商环境,辖区50余家企业参加会议。会议采纳“方针解读+事例分析+现场答

...[详细]

荆楚网湖北日报网)讯通讯员 陈园)7月3日,江陵县消防救援大队举行优化营商环境信誉修正)会议,助力失期企业重塑信誉,建造诚笃守信营商环境,辖区50余家企业参加会议。会议采纳“方针解读+事例分析+现场答

...[详细]

-

西湖断桥地表温度超55℃,杭州热到全国榜首!气象台:没有夸大

极目新闻记者 唐佳燕。实习记者 金瑞安。近来,浙江杭州接连的高温气候在交际平台上引发网友们热议。据杭州归纳频道报导,记者查询我国气候网发现,7月2日14:00杭州以39.3℃的高温排名全国榜首。7月2

...[详细]

极目新闻记者 唐佳燕。实习记者 金瑞安。近来,浙江杭州接连的高温气候在交际平台上引发网友们热议。据杭州归纳频道报导,记者查询我国气候网发现,7月2日14:00杭州以39.3℃的高温排名全国榜首。7月2

...[详细]

-

5月22日拍照的第四届我国-中东欧国家饱览会暨世界消费品饱览会开幕式。新华社记者 黄宗治 摄。新华社杭州5月24日电。 题:我国与中东欧国家经贸协作驶入“双向快车道”。新华社记者程潇、高帆、鞠银河。捷

...[详细]

5月22日拍照的第四届我国-中东欧国家饱览会暨世界消费品饱览会开幕式。新华社记者 黄宗治 摄。新华社杭州5月24日电。 题:我国与中东欧国家经贸协作驶入“双向快车道”。新华社记者程潇、高帆、鞠银河。捷

...[详细]

-

荆楚网湖北日报网)讯通讯员李进东、肖怡)7月2日,大悟县丰店镇第五期“辣味”讲堂如期举行。本期讲堂聚集辣椒工业开展主题,安排村干部登台共享实践经历、沟通作业心得,着力提高其引领工业开展、服务大众增收的

...[详细]

荆楚网湖北日报网)讯通讯员李进东、肖怡)7月2日,大悟县丰店镇第五期“辣味”讲堂如期举行。本期讲堂聚集辣椒工业开展主题,安排村干部登台共享实践经历、沟通作业心得,着力提高其引领工业开展、服务大众增收的

...[详细]

-

荆楚网湖北日报网)讯通讯员 朱倩)“没想到躺在病床上也能办成事,这服务真暖心!”近来,湖北丰亮商贸有限公司经办人丁先生经过手机视频连线,完结了本来需求跨县处理的企业紧迫事务。在孝南区政务服务中心与孝昌

...[详细]

荆楚网湖北日报网)讯通讯员 朱倩)“没想到躺在病床上也能办成事,这服务真暖心!”近来,湖北丰亮商贸有限公司经办人丁先生经过手机视频连线,完结了本来需求跨县处理的企业紧迫事务。在孝南区政务服务中心与孝昌

...[详细]

-

人民网北京7月3日电 方经纶)据中国农业科学院官网音讯,由中国农业科学院北京畜牧兽医研讨所、饲料研讨所等单位一起拟定的《肉鸭养分需要量》国家规范于7月1日起在全国正式施行。该规范提出了北京鸭、肉蛋兼用

...[详细]

人民网北京7月3日电 方经纶)据中国农业科学院官网音讯,由中国农业科学院北京畜牧兽医研讨所、饲料研讨所等单位一起拟定的《肉鸭养分需要量》国家规范于7月1日起在全国正式施行。该规范提出了北京鸭、肉蛋兼用

...[详细]

-

荆楚网湖北日报网)讯通讯员汤卫红、夏天然)为贯彻落实省委“干部本质提高年”和司法部“实战大练兵”要求,5月21日下午,江北监狱举办“思维政治教育”主题民警优质课比赛决赛。经过初赛、复赛层层挑选的11名

...[详细]

荆楚网湖北日报网)讯通讯员汤卫红、夏天然)为贯彻落实省委“干部本质提高年”和司法部“实战大练兵”要求,5月21日下午,江北监狱举办“思维政治教育”主题民警优质课比赛决赛。经过初赛、复赛层层挑选的11名

...[详细]

-

中新社洛杉矶7月2日电 (记者 张朔)美国加利福尼亚州约洛郡一座焰火库房当地时间7月1日黄昏产生屡次爆破并点燃野火,形成7人失踪。归纳加州林业和消防局最新火情通报和《洛杉矶时报》等美国媒体音讯,这座焰

...[详细]

中新社洛杉矶7月2日电 (记者 张朔)美国加利福尼亚州约洛郡一座焰火库房当地时间7月1日黄昏产生屡次爆破并点燃野火,形成7人失踪。归纳加州林业和消防局最新火情通报和《洛杉矶时报》等美国媒体音讯,这座焰

...[详细]

开过婚庆公司,考过爆炸证,被老板骂才华能当饭吃吗?毕赣,站上了戛纳领奖台

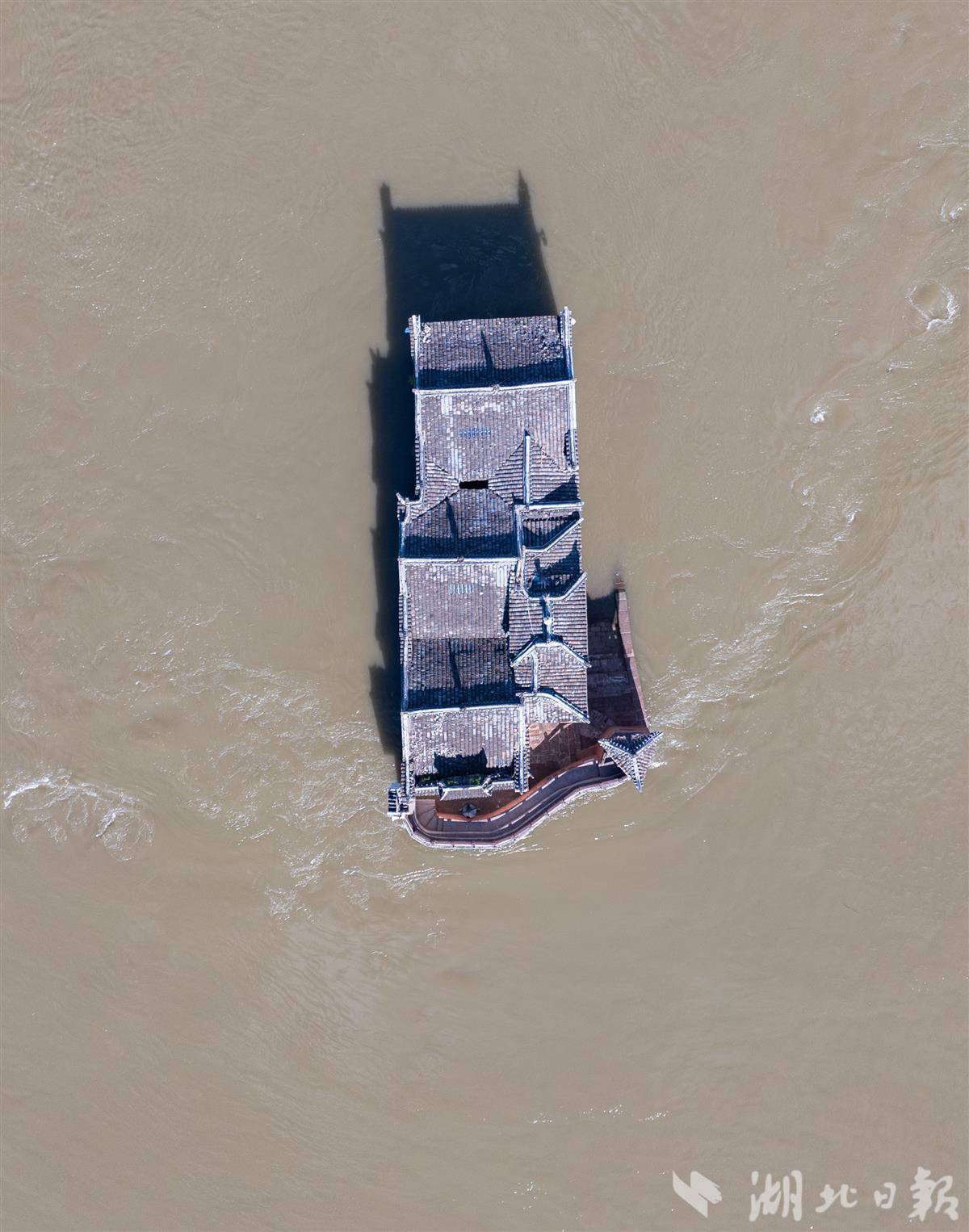

开过婚庆公司,考过爆炸证,被老板骂才华能当饭吃吗?毕赣,站上了戛纳领奖台 700年洪水冲不垮!长江观音阁隐藏古人修建才智

700年洪水冲不垮!长江观音阁隐藏古人修建才智 亚心专家巧堵“小心眼” 祛除父子俩头痛“紧箍咒”

亚心专家巧堵“小心眼” 祛除父子俩头痛“紧箍咒” 俄海军副司令在库尔斯克州遇袭阵亡

俄海军副司令在库尔斯克州遇袭阵亡 66吨非洲咖啡豆“空降”鄂州 中非空中丝路改写交易时速

66吨非洲咖啡豆“空降”鄂州 中非空中丝路改写交易时速